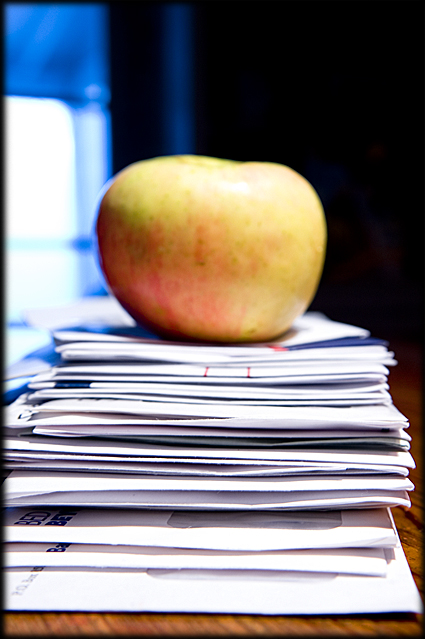

Does anyone want to guess what this is?

For those of you who guessed, “A blurry photo,” you are correct! But it is also a stack of credit card offers, collected over a one-month period.

The thing that’s so sick about this stack is that the economy is in the toilet due to over-extension, yet here are the banks poking their heads through Bossy’s mail slot trying to suck Bossy and her family back in.

In the last Poverty Post, Bossy and her posse discussed whether it was better to pay yourself first, or pay down your debt first — and the discussion led to whether it was better to pay off the smallest balance first, or the balance with the highest interest rate. And if you missed any of this, here was the consensus: (crickets.)

One thing everyone did agree on, is how willing credit card companies are to negotiate your interest rate, assuming your credit rating is OK.

Most of the time, all you need to do is call your credit card company and ask for a lower rate. Or sometimes you need to threaten to take your business elsewhere, where elsewhere equals one of the thirty-five offers sitting in a stack below a blurry apple.

Later this weekend Bossy will outline a suggested script for requesting a lower rate. It never hurts to ask. Of course, whoever said It never hurts to ask obviously didn’t mind talking on the phone as much as Bossy.

Speaking of low interest rates, Bossy’s husband says their two credit card balances have fairly manageable rates. The largest interest rate is 8.99%, and this is the card they are closest to paying off. The other credit card holds a 3.90% interest rate for the life of the loan, which is approximately forever.

In addition, a few years ago Bossy and her husband refinanced their house, where refinanced equals signing a paper in an air-conditioned office and then going to a lamp store across the street. And during this refinancing, Bossy and her husband were able to take advantage of a 5% 30-year fixed mortgage.

All of their other loans seem to have manageable rates, for instance 3.49% on the home equity line of credit, and 3.80% on Bossy’s Honda which, lordsy, is nearly paid off a handful of years later and it wasn’t even purchased close to new.

And that is everything Bossy knows about her current interest rates, and she guarantees she has never typed ‘%‘ so many times in her life.

Check back later this weekend for that tutorial on phoning your credit card companies, but first: beware of Transfer Fees if you should decide to transfer your balance from one card to another.

Asthmagirl says

Asthmagirl says

December 5, 2008 at 9:58 amKudos to Bossy for having the greatest rates around!

Kate says

Kate says

December 5, 2008 at 10:18 amYou know, if you want to stop getting all of those offers, all you have to do is to put a fraud alert on your credit w/the big three credit agencies – it’s free, and you get free copies of your credit report after you do so.

julie says

julie says

December 5, 2008 at 10:19 amThose are some nice rates.

(How did that manage to sound dirty? Wait, it only did to me? What?)

I tried to call my CC a few weeks ago and ask for a lower rate on the debt-to-end-all-debts card and was told “Sorry, ma’am, but you currently have the lowest rate we are able to offer.” My foot. (no, seriously, my foot–when he said that I accidentally tipped my office chair over, fell off, and cracked my toenail) But also? My foot. 19% is as low as they can go? Doubt it.

So definitely a good idea to have a threat to transfer it or the patience to push for a manager.

Denise says

Denise says

December 5, 2008 at 10:22 amWe had a good credit card rate experience, but only after a miserable one. AmEx sent a letter saying they were raising our interest rate to 28.99%. What?! That’s legal?! Apparently so.

My husband called to see if they would change it and, without missing a beat, the AmEx rep said, “how about 6%?” Crazy world.

Kristine says

Kristine says

December 5, 2008 at 10:53 amYou can also stop getting those offers by signing up for that opt-out thingy. I did it and I have so much less junk mail now.

jaxcheryl says

jaxcheryl says

December 5, 2008 at 10:56 amThe credit experts (whoever they are) always say never to switch your balances, but back in the day when we were juggling 3 hefty balances I would transfer the balances to the cc offer of 12 months 0% interest, no fees (read ALL the fine print). When that offer’s time frame expired, I transferred to the next similar offer. I did this juggling circus act until the balances were finally paid off. We never paid interest or fees for several years, and no, it never hurt our credit. I’ve often wondered if it was the cc companies that started saying it would hurt your credit to transfer balances just to keep you paying their interest. hmmm.

Half Assed Kitchen says

Half Assed Kitchen says

December 5, 2008 at 11:05 amI feel like I’m reading Simple Mom!

marchelle says

marchelle says

December 5, 2008 at 11:08 amcredit cards is tha debil.

alana says

alana says

December 5, 2008 at 12:59 pmmy husband was in credit card debt for a long time. he’s exacting his revenge on the usurous (word?) credit card companies thusly: taking advantage of an offer in the mail, he’ll get the largest credit limit he can. he’ll take the entire amount out as a cash advance and then put it in a c.d. or other investment (this was before the recession). even after cash advance fees, etc. he’s made a couple thousand dollars off of the credit card companies. small pleasures…

Tammy says

Tammy says

December 5, 2008 at 1:59 pmI have a suggestion for readers who are in a serious bind with credit debt: http://www.auritonnew.org/page/page/4765680.htm (disclaimer: I receive no benefit for recommending this company). I know that there are a number of unscrupulous companies claiming to consolidate debt and you have to be careful. But, we had nothing but good experiences with this company. We had *eek* $63,000 in credit card debt, four accounts with interest rates all higher than 20% (one was 28.99% – how are people supposed to keep ahead of that?). We were drowning. They came in and negotiated lower rates of 1%, 2%, 4% and 8% on the accounts. It wasn’t easy by any means, but we did it and as of October 2008, we are finally completely debt-free and what a great feeling that is. The really difficult part is having to close all the accounts and not have any open credit balances during the life of the agreement. If anyone has questions or wants more details, feel free to contact me. It changed our lives and probably saved our marriage.

Tootsie Farklepants says

Tootsie Farklepants says

December 5, 2008 at 2:49 pmCapital One really wants to be in our wallet. We get, and I’m not even kidding, an offer from the EVERY DAY (except Sunday, of course).

MarathonMom says

MarathonMom says

December 5, 2008 at 3:11 pmMy script usually starts out with

I would like to cancel this card.

Why?

The interest rate is too high.

Oh, we can change that….