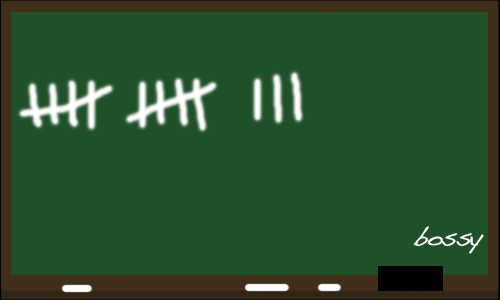

We interrupt this Poverty Party already in progress for a poll.

As the economic bottom continues to drop out, the news is full of statistics about the rise in foreclosures. Typically it takes a while for these things to hit home, no pun intended. A news report turns into an Oprah episode turns into a friend of a friend’s story, and then closer.

Bossy doesn’t know anyone who is stuck in a foreclosure nightmare, but she does know her own mother, who is renting out her beloved house for a year while she recoups her finances. And Bossy knows many people, in life and through the internet, who recently chose to downsize or otherwise move to more affordable situations, many of whom are in the rental market.

So, what Bossy would like to know — do you have any personal stories of foreclosures or shifts in your living situation? How close to home is this hitting, for you?

maureen says

maureen says

February 6, 2009 at 9:13 amwell, looks like I may be getting a divorce. So, do I rent and wait out this crap? Do I buy because home prices are lower and intrest rates are down? Worried about my job. We get our state contract renewed every fiscal, won’t know until June if I will have a job for another year. What state? Um, Illinois. blech. could the former Gov go into hiding already?

Mel says

Mel says

February 6, 2009 at 9:19 amWe mostly got hit by the credit crunch, since we were finally hammering out the purchase of the little house we’d been renting this past summer after two years of negotiations. Managed to close the sale at the beginning of October, then starting in December my partner stopped drawing a salary in order to help keep his business afloat. So far we’re doing okay on my income, but it’s a little scary, to say the least.

Alwyn says

Alwyn says

February 6, 2009 at 9:31 amMy mother just got laid off and, at the age of 62, has no nest egg. She is staying with a friend a whole coast away from where she was living, reluctantly drawing Social Security (for which she is now eligible), and is searching for employment. As she is a professional (i know, no nest egg….long story), the chances of being hired vs. some young buck are slim. She may end up living with me, my husband, and kids.

Acher says

Acher says

February 6, 2009 at 9:34 amOur condo has been on the market for nearly three years now (currently by owner). We don’t NEED to move, and our finances/mortgage are comfortable, but we’d LIKE to get out of our tiny condo and into a tiny house. We originally listed about two weeks before the bottom started to fall out in the summer of 2006. The problem is that we’ve lost so much value that if we’re not upside down on our loan yet, we will be soon. We can’t afford to take a loss and rent it, and we can’t refinance because we’ve lost enough value that we no longer have 20% equity. It drives me crazy that houses that were WAY out of our price range two or three years ago are now selling for less than we paid for our condo in 2004.

In all reality though, our troubles are nothing compared to those that are out of work or facing foreclosure. They’re not really troubles at all, I guess. Its an issue of want vs need, and we consider ourselves damn lucky that our “problem” is one of want, not need.

dgm says

dgm says

February 6, 2009 at 9:39 amThankfully, we’re in a good position on the house. We bought in back in 2001 when things were really booming and houses in this area were over a million. However, since the previous (and original) owner kept 3 cats, 3 dogs, and a turtle in here and didn’t update the look, this place was on the market for a long time. By the time we looked at it he was a desperate seller and we got it for a song. A good lesson for the Poverty Party when it comes to buying a house: remember you are buying a house, not a home. Don’t be fooled by how bad it looks–get it on the cheap and make the cosmetic changes yourself. We were able to get rid of the cat smell and the 40 years of dog hair.

As it stands today, although all housing values have dropped including ours, it’s still worth way more than we paid for it. Fortunately, we’re both still employed, too.

Lauren says

Lauren says

February 6, 2009 at 9:45 amWorking for my parents’ failing business for free AND loaning them money.

nono says

nono says

February 6, 2009 at 9:45 amWe’re up outside of Boston, and my husband owns his own rental business. He got through December okay, but January has been rough. HIs staff consists of a manager, and an assistant manager, utility worker, and usually 3-4 drivers/workers (all with homes & families of their own.) He laid off all but one driver/worker in December, and in January completely cut out the remaining employee’s regular 8 hours overtime they used to get each week. We’re holding our breath to see what damage February brings…he’s changed the store hours to opening 30 minutes later, and closing an hour earlier, to hopefully help with the payroll and the utility bills as well (he has NEVER changed his store hours before.) Once business starts to pick back up he can readjust and flex with it….we’re anxiously awaiting spring.

Julie says

Julie says

February 6, 2009 at 10:29 amWe’re okay house wise as our mortgage is almost paid off (although the house isn’t worth anything near what we paid for it right now), but my SIL lost her job last week, so now it’s starting to hit closer to home.

Jess says

Jess says

February 6, 2009 at 10:33 amWe got a foreclosure notice on Xmas Eve for the house we had been renting for the past 3 years. Apparently, the landlord hadn’t paid the mortgage in 6 months even though we paid our rent on time every month. We had to find a place to live and move in 3 weeks. That was fun.

imom says

imom says

February 6, 2009 at 10:46 amI work for a small steel fabricating company who has laid off all the shop workers and welders. We only have one small job lined up to start in a couple weeks, but that will bring back only a couple guys. Thankfully I’m very busy working in the office helping get estimates out on bidding jobs. It’s possible my hours will be cut because of budget cuts. We are being very careful about spending money at home because of this. Tough times all around.

jp says

jp says

February 6, 2009 at 10:47 amBought our house in 1996, thought about selling in 2006, missed the UP market. Now, we are both still employed, bonuses were cut, but still. We may rent the house out and move somewhere else and see what the future brings.

MyNameIsCat says

MyNameIsCat says

February 6, 2009 at 10:47 amWe’re in the exact same place as dgm -cat stench and all. We bought the house in ’99 for cheap, cheap, cheap (see cat stench above). We worked our butts off renovating/destinkivying, so we have a really nice home now that is almost paid for. Our friends built a fabulous show place at the same time and are now in a real risk of foreclosure. I’m very happy to be here worry free.

I feel very bad for people like Jess, who’ve been paying their rent on time and are still losing their homes because the landlord isn’t paying the mortgage.

Lizzy says

Lizzy says

February 6, 2009 at 11:08 amWe bought a larger house last Spring when things were still o.k. here, and hubby was looking at cashing in some stocks and getting a rocking bonus. Guess what? Stock is worthless, no bonus, no raises and a big drafty house that is a bitch to heat. We left our great little house for this monstrosity and now we are having to watch every. stinking. penny. We kick ourselves daily.

Also, the big, expensive house? It’s still big, but worth much, much less. Fortunately our taxes are astronomical, so we have that going for us.

The Subtle Rudder says

The Subtle Rudder says

February 6, 2009 at 11:13 amUgh. I overbought a house in my hometown in the spring of 2007. Yeah, right before the housing market tanked. Bitter much?? I still think about the cute little couple I bought it from, who made 50k on THEIR investment in this place, basically on my back. And I want to kick them. It’s a gorgeous old showplace, but it turns out I am not a natural homeowner: it’s way too big for 1 person and I did not inherit the gardening gene. Also, I never was a midwesterner. Not when I was growing up here, and certainly not now. I miss my coast, my ocean, my hip city with all the colorful people. (And by colorful , I mean exactly that: all races, full-body tats–man, just give me something different to look at!). My job got slower and slower over the past year, and I was finally laid off in December. Luckily, I found another job, but I would KILL to be able to get out from under this house and just get a tiny place to ride out the economy. Instead, I’m paying west coast prices and living a midwest lifestyle. Oh, and I can’t rent this place for even HALF what I pay every month. The most I could get from a roommate is $300. But I’m still looking for someone to share…So I’m in the downturn mix, but mostly lucky. My problems are a drag, but I eat. I’ve been able to pay my mortgage. I’m getting by.

Ann Fowler says

Ann Fowler says

February 6, 2009 at 11:17 amWe’re downsizing. Bought a bigger house almost 4yrs ago and luckily kept the smaller house as a rental. Plan to put the bigger house up this month. Fingers crossed we unload the larger house by the end of summer. Lesson: Big is not always better.

Sandy_Shoes says

Sandy_Shoes says

February 6, 2009 at 11:25 amMy husband lost his job back in October and is still out of work.

~annie says

~annie says

February 6, 2009 at 11:25 amSo far so good for me. I have an adjustable mortgage that is about to reset, but I think it’ll be OK. My brother is in the middle of a divorce and lost his job right before Christmas. He is extremely lucky in that he was able to sell his house and will walk away with a few $K to start over.

Lora says

Lora says

February 6, 2009 at 11:30 amSo far we are fortunate. Hubby still has a job and we can still afford our house. My only gripe is that we had to buy a house in mid-2007 (we had relocated across the country for his job) so the prices were still inflated. We’ve lost almost 40% of its value. We put down almost 50% – so the way I look at it, we didn’t just lose value, we lost actual cash. It makes me feel physically ill when I think of all the money we’ve lost on this house.

Debby says

Debby says

February 6, 2009 at 11:30 amMiddle of America w/no raises, but we have jobs and they look stable. Life is good for us and my heart goes out to those on the flip side

Kathy from NJ says

Kathy from NJ says

February 6, 2009 at 11:48 amFortunately our 1200 sq ft condo (no basement, no garage) is paid for but….

Husband’s 3rd stroke in Sept 2001 left him totally disabled & unable to speak. We’re living on his soc sec & investment income. Real estate taxes are now $6,000 & condo fee is $3,000 – my health insurance just went up to $900./month, husbands medicare & supplemental ins is $300/month. Investment income has tanked, now using principal to cover expenses.

Our plan had been to move to a less expensive state – those plans are on hold until there is a major change in our situation.

Heather says

Heather says

February 6, 2009 at 12:10 pmI’m in Michigan, and we haven’t been in foreclosure or trouble with payments, but my ex-husband had his home foreclosed on.

So far we’re ok, but normally pretty frugal so we went from feeling safe to barely making it.

chocolatechic says

chocolatechic says

February 6, 2009 at 12:12 pmThis is hitting fairly close to home for us.

Our mortgage isn’t suffering. (I always pay the bills first) However, our insurance premiums when up AGAIN, and the coverage when down AGAIN.

I haven’t gone to the grocery store in over a month, and I sold all my jewelry to pay the down payment so my daughter could have all her wisdom teeth removed.

P. from RI says

P. from RI says

February 6, 2009 at 12:16 pmI feel lucky when I look around me. I work for a large company in a job (that for now) is somewhat secure. I managed to get the job during the summer, before everyone stopped hiring. It is less money than I was making prior, but I don’t know what I would be doing now if I hadn’t landed this.

I’m renting a house at a reduced cost – I am the caretaker for the museum that sits in the front yard. Both are owned by a historic trust, so I don’t have to worry about a landlord defaulting on a mortgage. I worry a lot that my lease is ending in a few months and they might not want to renew. Then I’m in big trouble.

While I don’t make very much $$$ and I am raising two kids on my own I am thankful everyday. I am able to squeak by every week with a little bit left over. I feel for those that are in such dire circumstances.

Operation Pink Herring says

Operation Pink Herring says

February 6, 2009 at 12:30 pmWe got very lucky with timing and bought our house in 2003 when the market was great. It then skyrocketed in valued and has since dropped back down quite a bit, but we still stand to make out well when we sell.

My brother is about to lose his job and just bought a house and is trying to save up for a wedding in June, so that’s bringing the whole crisis home for me. I feel very lucky to still have a job and be able to afford our house for the moment.

Renee in Seattle says

Renee in Seattle says

February 6, 2009 at 12:42 pmPresently experiencing the squeeze: every month I write a check to my parents for $800 to help them out, and pay my husband’s mother $1,000 to watch our kids, while I have 3 growing kids who need things too, extravegant things like braces and food and socks without holes, and my oldest, bless his heart, is a freaking genious 4.0 student who wants to be a doctor! ……. okay, I just had to cry a little there….. I’m back now. I keep trying to tell him he could make way more money if he didn’t go to college and became a drug dealer, but he is having none of it.

On the bright side, my husband is employed still, and we just refinanced our home and will save $200 a month in our mortgage payment… which by my calculations will be paid off when I’m 148.

Jackie Whitley (Buried in Legos) says

Jackie Whitley (Buried in Legos) says

February 6, 2009 at 12:49 pmHave a BIL loosing his home to foreclosure because his deck refinish business in Atlanta tanked. He has already bounced back & has another job, but has to move to Denver.

From what I understand the subprime problem is regional. Mostly in the South & West.

Little Miss Sunshine State says

Little Miss Sunshine State says

February 6, 2009 at 12:54 pmOur landlord is in foreclosure. He hasn’t paid the mortgage since last MARCH!

As soon as the bank sells this place, we have to move.

pkzcass says

pkzcass says

February 6, 2009 at 1:15 pmWe’re good with the house. Bought our twin in the last recession in 1996. Everytime we were tempted to move out of what everyone calls a “starter home” (although we never looked at it that way), we decided that great summer vacations were more important than a McMansion with a family room off the kitchen. Boy are we glad now. Have pretty much redone the whole interior of the house and it’s nice and cozy. And the vacations we’ve taken have been pretty great too. My husband is in civil service, so his job is stable. My company may close in a year or two, but hopefully the recession will be on its way out by then. Even so, if I was laid off tomorrow, we’d be okay for awhile. I’m sorry for everyone’s problems with the economy, but it sure feels good to know that being frugal all those years was actually the RIGHT thing to do.

margalit says

margalit says

February 6, 2009 at 1:16 pmMy landlord inherited the house I live in, which is in a compound of 4 homes on a large lot of land. She is teetering on losing the house and I get to reap the bitterness, She charges tip top rent and does no repairs. Makes us pay for everything. So we’re looking for a new place to reside. We live on my disability, so we’re poorer than poor naturally, which hasn’t changed with the downturn.

However, up the street from us, someone was building a momument to bad style, a hideous abode with copper roof and gigantic double copper custom doors, a huge stone fence surrounding it, and about 8000 sq feet of UGLY home. Just horrid. Everyone was squawking about how horrid the house was and couldn’t want to check out the owner. But the house went into forclosure before it was ever finished, so now we have this hellacious home sitting empty and unfinished on the street. Nobody will EVER buy this home at anywhere near the builder’s price (several million). It’s kind of sad.

Eliza says

Eliza says

February 6, 2009 at 1:29 pmCount me as one of the renters losing a home to foreclosure. Our landlady offered to sell us the house in 2006 for $220K. It’s now being offered as a short sale for $140. Even if our credit wasn’t crap, we wouldn’t buy it. 3BR rentals in our neighborhood of small houses are nearly non-existant. We’ll probably have to move farther away from work and school. At least we were given a heads-up and have some time.

margie says

margie says

February 6, 2009 at 1:41 pmWe are doing ok. Our home is ancient and between the two of us, we’ve had it nearly 30 years. Needs some repairs but at least it is paid for. We have no major bills, just a, I consider small, balance on one credit card and a small car payment. Plus insurance which is very expensive, having a son on the policy who isn’t 25 yet. And high utility bills to keep an old drafty home warm/cool. But I consider us very fortunate as all three of us work.

Kelly Stern says

Kelly Stern says

February 6, 2009 at 1:42 pmWe are in foreclosure on the house you stayed in when you came to Richmond. The mortgage company dropped the ball when we had an offer back in July and August, and now the value of the house has dropped another $60K… Long story of the nightmare we have been going through, and once all the dust has settled, there will be one hell of a blog post over at my spot on the web… until then, we are enjoying living in a rental home that is bigger inside and out (for the dogs)… and a third of what our mortgage was… smooches!

Amy says

Amy says

February 6, 2009 at 2:21 pmWe rent an old, old, house in the middle of PA. Rent is reasonable but oil bills are not, especially since my Sig.Other lost his job and is currently only partially employed. Extra blankets and space heaters save the day…

ajjobe says

ajjobe says

February 6, 2009 at 2:24 pmHusband was a FT student (on armed services benefit money) through December. I was laid off Dec 1st. An old co-worker called about a temp job which I consider myself VERY lucky to have gotten, but it won’t last much longer and neither of us has found anything yet. No health insurance any more, which terrifies me. Thanks to my late, beloved Grandma, who held onto her house in Fairfield, CT and left the grandkids the proceeds from the sale after her death (when prices were still high and her neighborhood was burning hot), our house is paid for (which is why hubby could go to school). We’re better off than a lot of people, but I’m more worried than I’ve ever been, and that’s saying something.

Jenn @ Juggling Life says

Jenn @ Juggling Life says

February 6, 2009 at 2:58 pmThank goodness we never re-fid other than to cover improvements. Otherwise we could be totally upside down as our home value has dropped by 1/3.

I’m set to graduate in May and finish my student teaching next December. We thought we’d be heading into easy street with me working after 20 years as a SAHM. Now, who knows? Thankfully my husband was only unemployed for a month after being laid-off in November. Still, that cost us $5,600 in COBRA payments.

kay says

kay says

February 6, 2009 at 3:14 pmMy husband and I are renting a teeny, tiny house in a teeny, tiny town, and our landlord STILL found the balls to raise our rent. The landlord bought the house eight years ago from his grandmother for $30,000.

I’m pretty sure our rent payments for the last six years have probably paid off that mortgage.

We’re hoping to buy a house of our own, but my husband is self-employed (as a skydiver and hot-air balloon pilot, no less, so impossible to insure, too), and we look pretty much like gypsies, on paper.

My delicious ex-husband, on the other hand, has just snapped up his THIRD house in this buyer’s market, apparently on the fast-track to becoming some sort of land baron.

I could watch him burst into flames and wouldn’t be inclined to spit on him.

Did I mention that he still lives in my dream house? And drives a new car?

Moral of the story here: Marry money.

Gretchen says

Gretchen says

February 6, 2009 at 3:49 pmSmall home in midwest, paid for after 13 years, that decision is looking very smart right now and neither of us is in danger of losing a job. Very, very lucky.

Chrissy says

Chrissy says

February 6, 2009 at 4:08 pm…we moved to Alaska to further our careers and house in Tennessee is still on rental market. Didn’t sell. But has only been three weeks on the rental market in Knoxville, TN. Still, the house is moving much slower than normal. People aren’t even renting anymore. Every one is too freaked out to better their lives. Thanks big banks! Thanks, media!

Kate says

Kate says

February 6, 2009 at 4:29 pmWe bought a dump in Seattle for 120K in 1999, renovated it ourselves over the next seven years and sold it for 450K in ’06. Moved to an island and bought a bigger, newer house in the country. We have lost some of the value, but time will tell how much. I saw our old home listed this week for 325K. Ouch.

Cindy Z says

Cindy Z says

February 6, 2009 at 4:29 pmI have been seperated for three years now trying to live off the same salary in two places that we use to have troble managing with one. No they are laying off at his job. He has been there over 20 years. I have not workied more then retail part time in over 20 years. My old job from that long ago is fazed out. Youngest son still has at least 6 or 7 more years at home. If husband does get layed off we will be living in our van. Mager credit card debt to stay afloat the last three years. But I am trying to stay positive and pray a lot

reen says

reen says

February 6, 2009 at 4:38 pmI”m pleasantly surprised that a majority of your commenters seem to be getting by, it’s such a mess right now. And my sympathies go out to those who are feeling the downturn so brutally. I’m blessed with a relatively stable state university job, good bennies, etc., and I rent (now I have to start wondering about my landlord…hm…). But so many of my friends have been laid off/had to move/sell off property recently, it’s a huge drag to say the least.

Amelia says

Amelia says

February 6, 2009 at 6:04 pmWe almost lost our rental when our landlord was foreclosed on, but fortunately the bank that held the loans let us stay in the house until the loans were sold again. We just received a notice yesterday that the loans have been sold again and we’re paying rent to a management company now. So, hopefully it will stay that way.

My company recently let a handful of people go, fortunately I was not one of them. I am hoping that’s all they do. Fiance’s company is stable for the time being. Thinking about going back to school just for the sake of making student loans go back into forbearance.

So basically, all we’re doing is a lot of hoping.

Rooth says

Rooth says

February 6, 2009 at 6:14 pmUgh My heart goes out to those who are experiencing financial problems. I manage homeowners associations and some of our communitites have a 20-25 % foreclosure rates. Mainly it’s the people who bought in the last 4-6 years but those that refinanced and pulled $ out are finding themselves way upside down. People that are samrt and have a little cash have planend it right and are buying another home at a reduced price and letting the 1st one go back to the bank. With 20% of the homeowners association members NOT paying their monthly assessments imagine what that is doing to the community that now can’t pay their bills. It is chaos in Southern Califiornia and people are mad mad amd and did I mention very angry?

heidig says

heidig says

February 6, 2009 at 6:21 pmEx-husband lost his job today which doesn’t bode well for him or me. Husband just had shoulder surgery on Weds and is a self-employed carpenter. He will be out of work for 4 months. Health insurance for the surgery = none. This is the second surgery on the shoulder. Our savings are dwindling. Thank GOD I have a good job and am keeping my fingers crossed that this whole mess gets better soon!

caleal says

caleal says

February 6, 2009 at 6:35 pmI live in an apartment, and my parents have owned our house for a few years now. So I don’t know anyone personally.

I’m more being affected by the lay-offs. My boyfriend’s position just got eliminated, and so he has a few weeks to find a job. I’m pretty worried about making rent.

Jen says

Jen says

February 6, 2009 at 8:13 pmI don’t know a soul who is in foreclosure. BUT, I am in a pocket of TX where the economy is not so bad. I’m grateful for my husband’s job. Big time. There aren’t many foreclosures on the market here, honestly.

We are choosing to stimulate the economy by NOT getting a new garage door, or reflooring our bedroom. Instead we are going to NYC for a week in March. Will be eating PB&J’s until then.

Andrea's Sweet Life says

Andrea's Sweet Life says

February 6, 2009 at 8:24 pmMy brother-in-law is living in my pool house and has gone bat-shit crazy (literally), which I am now dealing with since his wife left him after they lost their house.

I’d say it’s hitting pretty close to home!

ranchgirl says

ranchgirl says

February 6, 2009 at 9:05 pmOy. I’m the one people compare themselves to when they want to feel better. At this point I’m actually rolling with the punches pretty well, but they just keep on coming:

Bought my first (and probably last) house after my divorce, three years ago. Lost said house to foreclosure last year. Took a job I found online and moved across the country to manage a guest ranch in New Mexico. The salary was miniscule, but I also had health insurance and free housing. (Common for ranch management jobs. The lucky ones get a side of beef, too!) That lasted a whopping ten months before the gazillion out-of-state ranch owner lost HIS shirt in the market and decided to close the ranch. I am now unemployed, uninsured and homeless (all three since Thanksgiving Day, ironically enough), with nothing left in savings and the Big Black Mark of foreclosure on my credit history.

I’ve been bouncing between friends’ places, picking up web design, writing and horse training gigs wherever I can, and trying to find something a little more permanent. I have a Masters degree, have run my own freelance business for 20 years (thank the horse goddess I have THAT to fall back on, although it’s not enough to rely on entirely!), and am also part of a unit that trains most of the police and SAR horses in the US. You’d think there would be SOMEBODY that would want to hire me! Eh. You would be wrong.

On the bright side, I’ve learned how to stay nimble and bend with the blows. I’ve re-learned how to appreciate and wrap myself in the so-called small things. I take nothing for granted, I live in the Now, and I kiss my dogs a lot more often than I ever used to.

It couldn’t possibly hit me any closer to home; it already HIT my home. Twice.

ranchgirl says

ranchgirl says

February 6, 2009 at 9:08 pmAire. GazillionAIRE out-of-state ranch owner.

The Cheap Chick says

The Cheap Chick says

February 6, 2009 at 9:11 pmI’m a (former, as of last week) Realtor, and in the last year and a half, I’ve watched a good third of my clients suffer through foreclosure. How did it affect me? Well, as I said, I’m now a FORMER Realtor. I just couldn’t take it anymore.

Martha says

Martha says

February 6, 2009 at 11:00 pmNever been more happy I went to nursing school 12 yrs ago. At the time all my friends were studying cool things like International Business, Anthropology, Ceramics, Screen Printing etc. I was the “sell out” because a steady reliable income was so important to me. There have been many many many times I have regretted my decision. Times that I hate being a nurse. This is NOT one of those times. I just got a raise, better benefits and better hours. We do have a big chunk o debt that needs to be knocked out….but not so big we are in any real trouble.

Martha

AnnP says

AnnP says

February 7, 2009 at 1:20 amMy husband just got laid off and we are keeping our fingers crossed that I keep job…I work in a school out here in Oregon where things are looking bleak. Who knows. But never have I felt more connected to the comfort of having eachother, my kids, hubby and I. Though the tears fall, we’ll make it no matter what gets thrown at us.

bridget says

bridget says

February 7, 2009 at 2:00 ami’ve had my Mcmansion on the market for 9 months. We are trying to short sale the dam thing for 200k less than we bought it for.

I’ve moved my family to the country and could not be happier,

i pray now for just enough, never too much.

Deborah Non Blogger says

Deborah Non Blogger says

February 7, 2009 at 3:41 amIt seems that things are not quite as bad in Australia as we are hearing in the US.

I started to say that we are lucky…but that’s not really true. We made decisions early in our married life that suited us at the time….and now we are reaping the reward.

The reward being a buffer in hard times.

We were never the McMansion types. We wanted an old house, little debt and to see our girls educated well.

Soooo I worked for 20 years and we paid off the mortgage. Then we paid cash for things we really wanted and paid for our girls to go to good schools.

Then I took what my husband laughingly called my early retirement! LOL

Now…on the downhill slide to 50, we have no debt, decent assets and good superannuation (IRA’s?…retirement savings)

Frankly, with my husbands job secure, things are looking good (…if that last daughter would just leave home LOL)

http://www.flickr.com/photos/whitequeenbc/sets/72157613460930922/

Around us though we can see the pressure on friends and family hitting home. Children are being pulled out of private (fee paying) schools, wives are getting part time jobs. Retirees are groaning about lost share income and registering for pensions. There are a LOT of houses up for sale and people have just stopped spending.

We worry for friends who upscaled their houses and are struggling with huge mortgages. My oldest daughter is 27 and some of her friends say they don’t even hope to own their own home.

No real hardship yet but a great deal of reassessing of priorities.

…but you can see the dark clouds on the horizon. Everyone is holding their breath.

MariaV says

MariaV says

February 7, 2009 at 9:34 amWe’re doing okay so far. We only have to pay for taxes on our house. My husband is out on disability, but we are doing okay with my salary. My company froze hiring and salaries and we are trimming expenditures to the minimum.

Emily says

Emily says

February 7, 2009 at 1:05 pmWe are mostly doing okay however the credit card debt doesn’t seem to go down much no matter what! If it isn’t high phone bills, it’s the electric/gas ($421 this month!!!!), or car insurance.

I’ve always been the primary breadwinner and while dh is working fairly steadily these days being in the arts it doesn’t pay much and isn’t always very regular.

We would like to sell our house next year so my daughter can go to high school in a better school district, but with the housing market the way it is, plus the fact that it is an old house for which we haven’t been able to do the renovation it needs I don’t know if we’ll be able to pull it off.

Possibly we’ll rent the house, and then rent an apartment in the next county for that time – we’ll see.

KimS says

KimS says

February 7, 2009 at 1:15 pmDH got laid off twice last year – once in the summer, and then from the thank-god-we-got-this-one job. I’m subbing, he’s picking up consulting gigs here and there – we’re both watching the 2 year old. So far the house is safe… that’s our financial goal for 2009. Hold on to the house.

Bossy's Friend Martha's Sister says

Bossy's Friend Martha's Sister says

February 7, 2009 at 5:13 pm5 of the new teachers hired where I worked last year just got laid off for next year. I hope the trend does not move to my new school being that I am now on the bottomest bottom of the seniority list. But I am so optimistic, YES WE CAN! and I am the right teacher for my job!

Shelley says

Shelley says

February 7, 2009 at 5:44 pmBack in November, I found out that my company was closing its Phoenix office, so I was going to be out of a job. My job ends this coming Friday. My job was outsourced to India. Nice, right? Thank goodness for a small severance and a retention bonus.

My husband, who was in computer sales, saw senior sales reps getting laid off left and right. He survived two rounds of layoffs but saw the handwriting on the wall. Before he was laid off, he quit and took a job that was offered to him from a customer of his. The only catch is that the job is in Denver. He is already living there on working at his new (and way, way better) job, and the kids and I are staying here to finish the school year. So I guess it has worked out ok for us, except that I am moving to Denver. Which may not turn out to be a bad thing. We have been living in a rental house so at least we don’t have to worry about trying to sell a house in this market.

sugarpie says

sugarpie says

February 7, 2009 at 6:42 pmSo far so good, but because of high oil prices earlier last year, Houston has been very isolated from the worst (whew!). Any sentient being, though, sees what’s coming.

Also, I would like to caution those who have been gloating, see above, not to take too much for granted. Hubris, y’all.

Deborah Non Blogger says

Deborah Non Blogger says

February 7, 2009 at 7:56 pmI hope I didn’t come across as gloaty…that would be farthest from my mind.

If some of us are doing alright at the moment what we’re really feeling is unbounded relief.

…and empathy, because you’re right sugarpie…it could be our turn next.

Heide says

Heide says

February 7, 2009 at 8:12 pmWe’re incredibly lucky: I have a nearly recession-proof job as a tenured English professor. But our kindergarten-aged son recently got into a great public school (K-12) at the other end of Manhattan. The school run varies from 30 minutes to over an hour, depending on the day and what’s on at the UN. We put our coop on the market, and … we’ve been waiting.

Peg says

Peg says

February 8, 2009 at 10:13 amWell, thanks to Bossy’s Poverty Party, I took a second job last year to pay off all debt and am so thankful I did. My full time position (of twenty years) evaporated at the end of Dec and my part time job turned into a full time, highly lucrative situation. I am certainly not gloating, just very thankful that things have worked out as they have. I didn’t see it coming and would have been on the street. Bossy, thanks for having my back!

Mrs. Kindergarten says

Mrs. Kindergarten says

February 8, 2009 at 10:15 amI actually had to prioritize bills last month and decide who would really cut me off and who would just make threatening phone calls until I could afford to pay them again. House, car, gas, electric, phone – these got paid. Any and all cc bills got deferred a month so that I could buy groceries and insulin for my diabetic kid instead.

My mother, who has worked at the same job for the last 33 years, is getting layed off as of 4/15. She’s in poor health, with HS diploma, no marketable job skills, and no savings. What is she going to do?

My step-brother and his wife lost their house last month. Supposedly the mortage company was working out a deal with them. In reality they got a foreclosure letter and 3 weeks to vacate.

DH and I are both incredibly thankful that we are in fairly “safe” jobs (I’m a kindergarten teacher with tenure, he’s a social worker at the local prison) but we are still having to slash expenses to the bone and having trouble making the ends meet.

Melanie @ MelADramatic Mommy says

Melanie @ MelADramatic Mommy says

February 9, 2009 at 5:35 amI hope everyone here is able to hang in and come out the other side much stronger. I was laid off in November 2007. So far we’re doing well. Living in California is expensive but we’re trying to be careful and my parents have been a really big help with the unexpected stuff like needing my wisdom teeth pulled and the crowns I need.

Alissa says

Alissa says

February 9, 2009 at 8:39 pmMy little brother, the entrepreneur, has of lately been unable to pay his commercial mortgage 100%. On top of that, he was unable to pay the property taxes due in December (stupid month for taxes, say I, a CA resident and property owner). Consequentally, he is now in default with the lender, a goverment agency with the initials SBA who refuses to renegociate the terms so brother can, you continue to make the payments.

I guess the SBA would rather own a fairly useless building and let a small business bringing in over $1mil/year in taxable income and employing 15 people go under because that’s what is happening. Also, the SBA would like to own brother’s house and let him move in with a family member (NOT his sister).

Alissa says

Alissa says

February 9, 2009 at 8:41 pmThat last paragraph should end as follows:

“so brother can, you know, continue to make the payments.”

plutopup says

plutopup says

February 11, 2009 at 9:23 amWe took the plunge & bought our first house this past summer. My husband is disabled, still waiting for his SSA appeal hearing, so mine is the only income. Fortunately, I work for the Fed. Gov’t., so my job is pretty secure. The house is our only debt, save for some medical bills. Each month is a struggle to cover the bills (hello, gas & electric), but we’re adjusting to our new lifestyle by doing things like cooking at home and going to the library. So far, so good.